Most people work for decades to save for the retirement they envision. But all that hard work can be quickly undone by an untimely dip in the market. That’s the reality of sequence of returns risk.

The hidden risk in employees’ retirement portfolios

There are many risks inherent in retirement investing, but not everyone is aware of the sometimes dramatic impact of sequence of returns risk. Simply put, it means that the order—or sequence—and timing of poor investment returns can have a significant impact on the longevity of a retirement portfolio and the income it generates.

Typically, retirement portfolios are composed of investments that go up and down—and over the long run, they can potentially provide enough growth to help mitigate the impact of withdrawals made in retirement. However, if the market experiences a significant decline in the very early years of retirement, it can have a detrimental impact on employees’ retirement portfolios. That’s because employees will have to sell more investments to access the cash they need in retirement, which leaves them with fewer assets to potentially generate retirement income returns down the line.

So what about a major market decline later in retirement? While not ideal, employees may not need their portfolios to last as long, so a dip in the market in the later years is less likely to have an impact on retirement income.

Sequence of returns risk in action

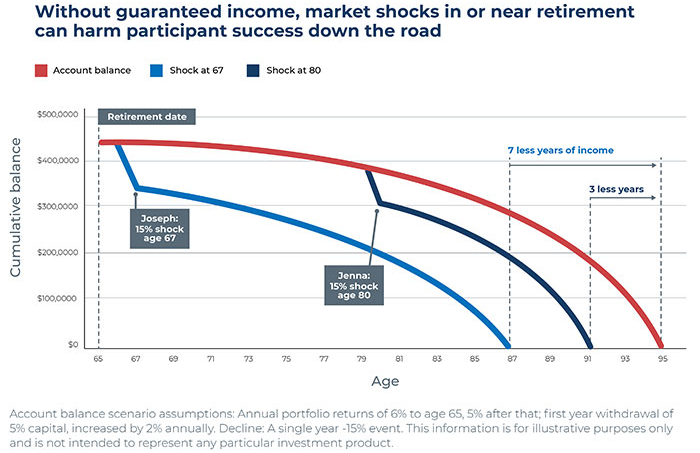

Let’s take a look at how sequence of returns risk plays out in two different scenarios. Jenna and Joseph both have $440,000 in retirement assets when they retire at age 65. At age 67, Joseph experiences a 15% market shock, which dramatically impacts his portfolio. However, Jenna experiences a 15% market shock when she’s 80. Because Joseph experiences a decline earlier, he runs out of money far sooner than Jenna.

Sequence of returns risk can wreak havoc on employees’ financial stability and comfort in retirement. So what can you do to help employees mitigate the risk?

Guaranteed income for life may reduce sequence of returns risk

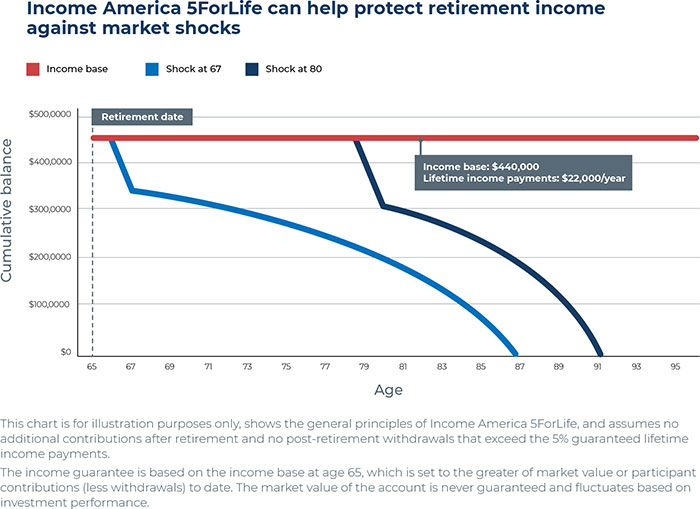

Choosing a guaranteed retirement income solution, such as Income America™ 5ForLife, can help to address this risk. By offering Income America 5ForLife as part of a retirement plan, you can give employees the security of never outliving their retirement income. That’s because all participant contributions and any market growth will be used to create a 5% annual guaranteed income for life beginning at age 65 or older.1

Here’s what could have happened if Jenna had chosen Income America 5ForLife instead of leaving her retirement portfolio up to chance. When Jenna turns 65, her Income America 5ForLife income base (used to calculate the guaranteed retirement income amount) is determined to be $440,000, which cannot go down even if the market drops. Plus, if she chooses, she can continue contributing and adding to her income base. Best of all, she’ll begin receiving lifetime retirement income payments of 5% of her income base every year, for the rest of her life. Guaranteed.

Income America 5ForLife can help counter market volatility risks by mitigating sequence of returns risk. That means more financial security and control for plan participants in retirement.

Help employees plan for a less risky future

Offering Income America 5ForLife helps employees manage their sequence of returns risk. Even investing a portion of their retirement portfolio in Income America 5ForLife ensures they have an income stream that isn’t dependent on market conditions.

1 To receive the guaranteed income, a participant must stay invested in Income America 5ForLife. If the participant withdraws more than the guaranteed annual income in any year, their income base and future guaranteed annual income amount will decrease. If the joint option is elected, the payout will be lower than 5%, depending on the participant’s age and their spouse’s age. Guarantees are subject to the claims-paying ability of the issuing companies.